Paid time off (PTO) is one of the most sought-after benefits in today’s workforce. While offering PTO isn’t legally required in most places, it’s practically essential for companies aiming to attract and retain top talent. PTO allows employees to take paid time off for vacations, sick days, personal time, or other types of leave. But how does PTO accrue? This article dives into the details, answering key questions about PTO accrual and providing actionable tips for employers and employees alike. Whether you’re managing a team or planning your next vacation, understanding how PTO accrues is crucial for making the most of this valuable benefit.

What is PTO? A Quick Overview

PTO, or “Paid Time Off,” refers to the time employees can take off work while still receiving their regular pay. Unlike traditional leave policies that separate vacation days, sick days, and personal time, PTO often consolidates these into a single balance, giving employees the flexibility to use their time as they see fit.

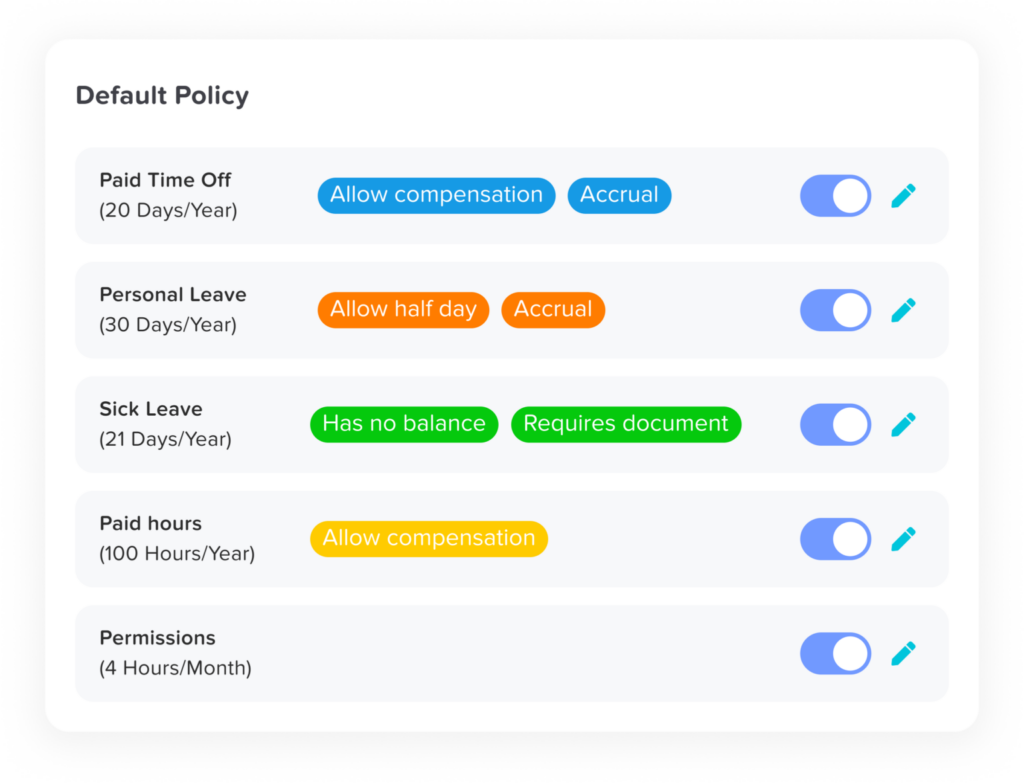

PTO policies can vary widely, depending on the company’s size, industry, and location. Some employers offer a lump sum of PTO at the start of the year, while others use an accrual system where employees earn time off incrementally based on their hours worked.

Now, let’s dive deeper into how PTO accrual works and the different ways it can be structured.

Ways to Offer PTO

Employers have flexibility in how they provide PTO to their teams:

- Annual PTO Bank: Employees are given a set number of PTO days or hours at the beginning of the year, which they can use as needed.

- Unlimited PTO: Employees can take as much time off as they want, as long as they meet performance expectations and comply with company guidelines.

- Accrued PTO: Employees earn PTO gradually, based on the number of hours they work. For example, the more hours an employee works, the more PTO they accrue over time.

For companies using an accrued PTO system, it’s important to define clear guidelines about how and when PTO is earned.

How Does PTO Accrue?

PTO accrual is the process by which employees gradually earn paid time off over time, rather than receiving it all at once. The accrual rate typically depends on factors such as the number of hours worked, the company’s policy, and the employee’s tenure.

1. Hourly Accrual

Hourly accrual is one of the most common methods of calculating PTO, especially for employees with variable schedules or part-time roles. In this system, PTO is earned based on the number of hours worked.

For example:

- A company offers 80 hours (10 days) of PTO annually to full-time employees working 2,080 hours per year.

- Divide the annual PTO (80 hours) by the total work hours in a year (2,080):

- 80 ÷ 2,080 = 0.0385 hours of PTO accrued per hour worked.

- An employee working 40 hours in a week would earn:

- 0.0385 × 40 = 1.54 hours of PTO per week.

This method allows employees to see their PTO grow in real-time, making it a transparent and equitable approach for tracking leave.

2. Pay Period Accrual

With pay period accrual, PTO is earned regularly, aligning with the employee’s pay schedule. This method is straightforward to manage, especially for salaried employees.

For example:

- An employee earns 120 hours of PTO annually.

- If they are paid biweekly (26 pay periods in a year), divide the annual PTO by 26:

- 120 ÷ 26 = 4.62 hours accrued per pay period.

This system provides consistent yearly PTO growth, giving employees a predictable timeline for earning leave.

3. Monthly Accrual

In monthly accrual systems, employees earn PTO in fixed amounts each month. This is often used in companies that prefer to simplify the accrual process.

For example:

- An employee receives 120 hours of PTO per year.

- Divide 120 by 12 months:

- 120 ÷ 12 = 10 hours accrued per month.

This method is easy to calculate and provides employees with regular updates on their available time off, making it ideal for small to mid-sized businesses.

4. Annual Lump Sum

In an annual lump sum system, the total amount of PTO is provided upfront at the start of the year. While this isn’t technically “accrual,” it’s a common approach for companies that want to give employees full access to their leave balance immediately.

For example:

- On January 1st, an employee is granted 120 hours of PTO to use throughout the year.

While convenient for employees, this method can pose challenges if employees leave mid-year or use all their PTO early in the year, leaving no remaining time off for emergencies.

5. Tenure-Based Accrual

Many companies reward long-term employees by increasing their PTO accrual rates over time.

For example:

- New employees earn 80 hours of PTO annually.

- After three years of service, they earn 120 hours annually.

- After five years, they earn 160 hours annually.

This approach incentivizes employee loyalty and recognizes the contributions of seasoned team members.

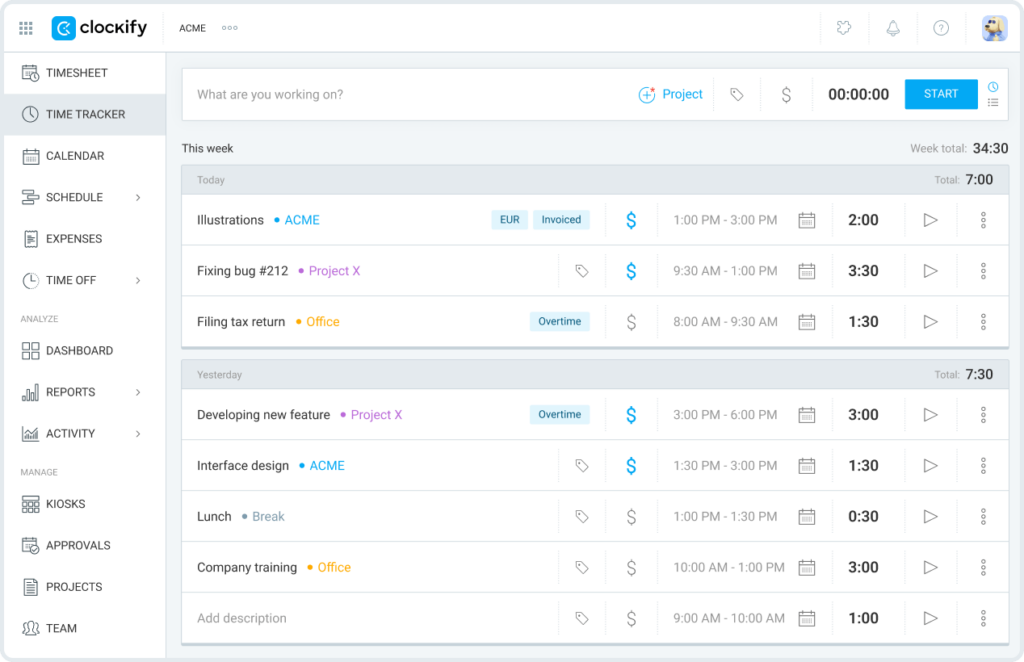

How to Calculate PTO Accrual

Understanding how PTO accrues can help employees plan their time off and employers ensure their policies are fair and transparent. Let’s walk through a step-by-step example of calculating PTO accrual:

Determine Total Annual PTO:

Decide how many hours of PTO employees will receive in a year (e.g., 120 hours).Identify Total Work Hours in a Year:

For full-time employees, this is typically 2,080 hours (40 hours per week × 52 weeks).Calculate Hourly Accrual Rate:

Divide the total PTO hours by the total work hours:- 120 ÷ 2,080 = 0.0577 hours accrued per hour worked.

Calculate Weekly Accrual:

Multiply the hourly accrual rate by the number of hours worked per week:- 0.0577 × 40 = 2.31 hours per week.

By following this formula, you can calculate accrual rates for any PTO policy, making it easy to adjust for part-time schedules or changes in work hours.

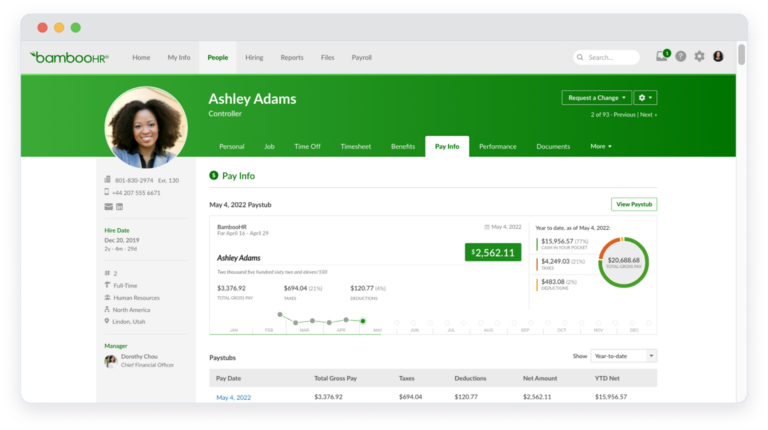

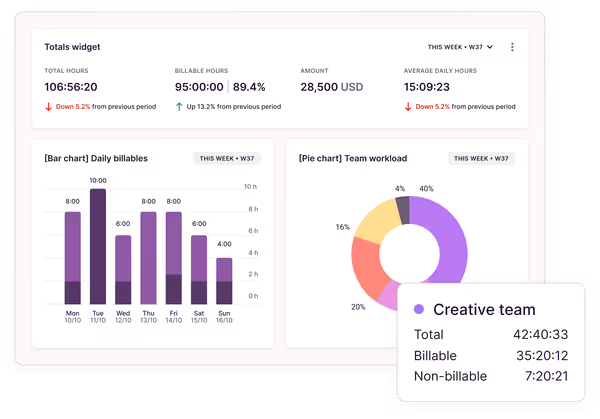

Payout of PTO

PTO payout applies when an employee leaves a company. Employers calculate the value of accrued PTO by multiplying the employee’s hourly rate by their unused PTO hours. This calculation applies to both hourly and salaried employees:

- Hourly Employees: Multiply their hourly wage by the number of unused PTO hours.

- Example: An employee earning $15/hour with 10 unused PTO hours would receive $150.

- Salaried Employees: First, determine the hourly rate by dividing their annual salary by total work hours (e.g., $40,000 annual salary ÷ 2,080 hours = $19.23/hour). Then multiply this rate by unused PTO hours.

- Example: With 15 hours of unused PTO, the payout would be $288.45.

State Laws on PTO Payouts

Some states require employers to pay out unused PTO when an employee leaves. As of now, 24 states, including California, Illinois, and New York, mandate PTO payouts under certain conditions. Employers in these states must ensure accurate PTO tracking and adherence to payout laws to avoid potential legal issues.

FAQ: Common Questions About PTO Accrual

1. Can PTO be used before it’s accrued?

Yes, in some cases. Many companies allow employees to “borrow” PTO before it’s accrued, creating a negative balance that is later offset as more PTO is earned. However, this depends on the company’s policy. If an employee leaves before repaying the borrowed PTO, the employer may deduct the negative balance from the final paycheck, subject to state laws.

2. Do holidays count as PTO?

No, holidays typically don’t count as PTO unless explicitly stated in the company’s policy. Paid holidays like Thanksgiving, Christmas, or Independence Day are usually separate from an employee’s PTO balance.

3. Can unused PTO be converted into cash?

This depends on the company’s policy and state laws. Some companies offer a PTO payout program, allowing employees to cash out unused hours at the end of the year or when they leave the company. In certain states, unused PTO must be paid out upon termination, regardless of company policy.

4. What happens to PTO if an employee switches from full-time to part-time?

When an employee transitions from full-time to part-time, the PTO policy is often adjusted to align with the reduced hours. Employers may prorate the remaining PTO balance based on the new schedule. It’s important to clarify how accrued PTO will be handled during this transition.

5. Can employers make changes to the PTO policy?

Yes, employers can change their PTO policy, but they must communicate the changes to employees in advance. Additionally, accrued PTO is considered earned compensation in some jurisdictions, meaning employers cannot retroactively reduce or revoke it without violating labor laws.

6. What is the difference between PTO and vacation days?

PTO is a broader term that includes all types of paid leave, such as vacation days, sick leave, personal time, and more. Vacation days are specifically designated for leisure or personal travel, while PTO can be used for a variety of purposes depending on the company’s policy.

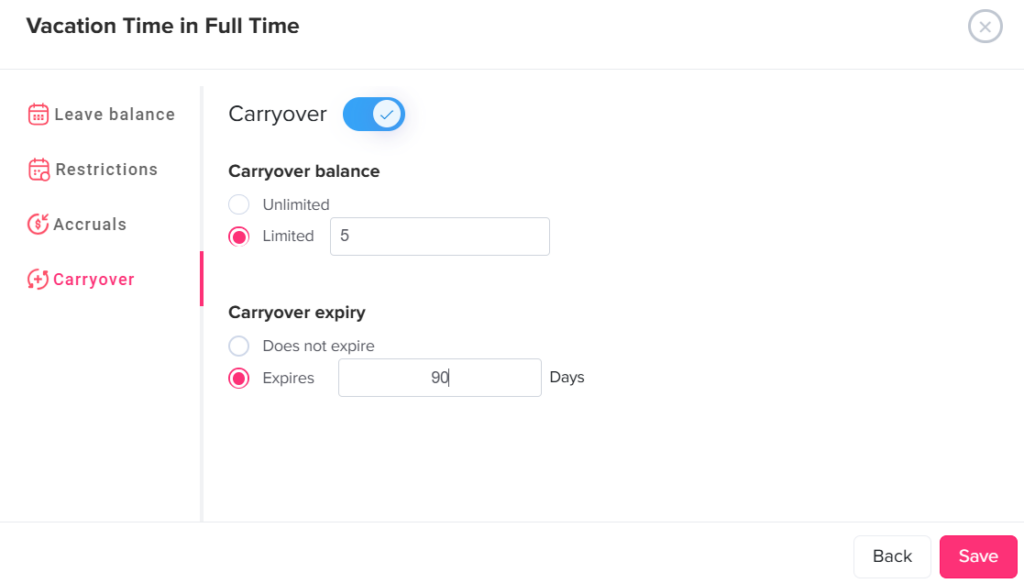

7. Is there a limit to how much PTO an employee can accrue?

Most companies set a cap on PTO accrual to prevent employees from accumulating excessive hours. For instance, an employee might stop accruing PTO once they reach 200 hours. This cap encourages employees to use their time off instead of hoarding it.

8. How is PTO handled during a leave of absence?

During a leave of absence, PTO accrual typically depends on the type of leave and company policy. For paid leaves (e.g., maternity leave), employees may continue to accrue PTO. For unpaid leaves, accrual usually pauses until the employee returns to work.

9. Can PTO be used in increments (e.g., hours instead of days)?

Yes, most companies allow employees to use PTO in smaller increments, such as hours instead of full days. This flexibility can be especially helpful for appointments, family obligations, or personal errands that don’t require a full day off.

10. How do probationary periods affect PTO accrual?

Probationary periods typically delay when new hires can begin using PTO. For example, an employee might start accruing PTO immediately but be restricted from using it until they’ve completed a 90-day probationary period.

11. Are there penalties for not using PTO?

Some companies enforce a “use it or lose it” policy, where unused PTO expires at the end of the year. In contrast, other companies allow rollover or PTO payout. Employees should be aware of their company’s specific rules to avoid losing earned benefits.

12. Can PTO be transferred to another employee?

Some companies allow PTO donations, enabling employees to transfer unused PTO to a colleague in need, such as someone dealing with a medical or family emergency. These policies are typically outlined in the employee handbook.

Conclusion

In conclusion, understanding how does PTO accrue is essential for both employers and employees to maximize the benefits of paid time off. By learning about different accrual methods, calculations, and best practices, you can ensure a fair and transparent process that supports workplace satisfaction and productivity. Whether you’re implementing a new PTO policy or planning your next vacation, knowing how does PTO accrue empowers you to make informed decisions and take full advantage of this valuable benefit.